I read another article about this topic and it shocked me.

“The fund currency of an ETF is purely cosmetic and represents neither risk nor opportunity; it doesn't matter."

The statement is not true.

Why?

Because the currency market fluctuates a lot.

The statement would be more correct with the addition:

It may not matter if you invest monthly for 30 years on a savings plan.

Want to understand currency risk?

Good.

Read on!

Currency risk definition

Currency exchange rates change. You know that from traveling: one year you exchanged $1.50 for a €1, and another year it was only $1.

Exchange rates are created in the currency market.

What is the currency market?

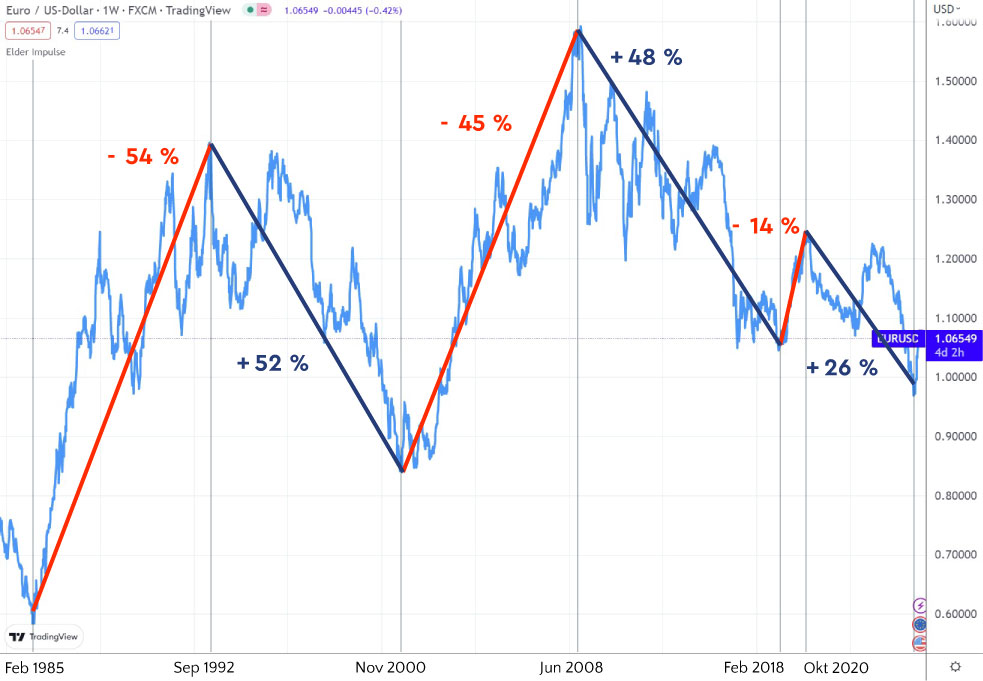

The currency market shows the current exchange rate. In principle, it is a sideways market: The euro / US dollar (USD) has fluctuated in the range of 0.60 to 1.60 from 1984 until 2022.

Fluctuating exchange rates mean that your investments in stocks or ETFs in a different currency are subject to additional risk.

Experts call this currency risk.

What does that mean?

Currency risk arises when you invest in stocks or ETFs in a currency other than your home currency, due to the changing exchange rates.

A currency risk example.

You live in Berlin, have your account in euros and want to buy Apple shares. Apple is a North American company and is quoted in US dollars. Or you invest in the global MSCI World index, the US index S&P 500, Dow Jones Industrial Average or NASDAQ Composite. The exchange rate changes. And suddenly your investment is worth less in your home currency.

Here is a concrete sample calculation.

On June 22, 2022, you buy shares in an ETF that is quoted in USD for €10,000.

In this currency risk example, the price of the ETF does not change. The exchange rate EUR/USD corresponds to the current data.

Date | ETF course | EXchange rate EUR/USD | Value of your investment | Performance at buy price |

|---|---|---|---|---|

06/22/2022 | 100 | 0.95 | €10,000 | |

09/22/2022 | 100 | 1.00 | €9,500 | - 5.0% |

12/15/2022 | 100 | 0.93 | €10,215 | + 2.1% |

You can see that if the ETF price remains constant, the exchange rate can have both a positive and a negative effect: the value of your investment decreases or increases. And all of that in just half a year.

If you invest more money, the absolute currency fluctuations will also increase.

When is there a currency risk?

Other currency

Currency risk is present when you invest in stocks or ETFs that have a different base currency than your home currency.

While ETFs are also available in a currency-hedged version, stocks are only available without currency hedging. Depending on the base currency in which your shares are listed, this will be higher or lower.

Euro, Swiss Franc, Great British Pound are mostly correlated and are not subject to such great currency risks. If, on the other hand, you want to invest in stocks from the USA, there is a significant currency risk. The US dollar is negatively correlated with the euro. That is, if the euro rises, the US dollar falls and vice versa.

Short investment period

There is a currency risk if you invest with a savings plan for less than 30 years.

When making your investment decision, you should definitely be aware of how long you want to hold your position. Is it a few months? Five to 10 years or more than 20 years?

Investment period | Should you be concerned with currency risk? |

|---|---|

Some Months | Absolutely |

Up to 5 Years | Absolutely |

More than 30 Years | Not important |

One-time investment

The amount of the one-off investment does not matter. The currency risk exists because you only invest at a single point in time and therefore do not receive an average exchange rate for your investments.

Calculate currency risk

To calculate your currency risk I assume the following:

The euro/US dollar currency market is sideways and moves in the range of 1.50 – 0.88 EUR/USD.

The upper and lower limits are used to calculate the potential or risk of your investment for the next few years or decades.

Calculation example.

You make a one-time investment of €10,000 in a non-currency-hedged ETF on the S&P 500 Index on 01/02/2023.

Exchange Rate EUR/USD | Value of your Investment | Percent Risk or Potential | |

|---|---|---|---|

Current | 1.068 | € 10.000 | |

Risk | 1.50 | € 7.120 | - 28.8% |

Potential | 0.88 | € 12.136 | + 21.4% |

The risk is towards the top of the sideways market up to an exchange rate of around EUR/USD 1.50.

The potential exists up to the lower values of the sideways market up to an exchange rate of approx. 0.88 EUR/USD.

The real values in the future may deviate from this.

How can you protect yourself from currency risk?

ETF with currency hedging

Most major index ETFs are available with and without currency hedging. The main difference for you is that the total expense ratio (TER) is slightly higher for the currency-hedged ETF.

I compared two ETFs on the S&P 500 Index at JustETF and listed the main differences for you.

iShares Core S&P 500 UCITS ETF (Acc) | SPDR S&P 500 EUR Hedged UCITS ETF | |

|---|---|---|

ISIN | IE00B5BMR087 | IE00BYYW2V44 |

WKN | A0YEDG | A2AGXP |

Fund Currency | USD | EUR |

Index Type | Total Return Index | Total Return Index |

Physically | Physically | |

Replication | Full replication | Full replication |

Currency Risk | Currency not secured | Currency hedged |

Total Expense Ratio (TER) | 0,07% p.a. | 0,12% p.a. |

You pay a little more for a currency-hedged ETF. However, the annual cost of currency hedging is significantly lower than the currency risk you take on with your investment.

The following graph shows a comparison.

Blue: S&P 500 ETF unhedged / Green: S&P 500 ETF currency hedged / Black: S&P 500 Index](https://images.ctfassets.net/wejpe8yzflc3/6YuwTB3LRZbAWrmwHgv6uz/e1deda4cea43d2c13bcfbe2478c0bad5/ETF_S_P500_vergleich_5.jpg)

You can see that the currency-hedged ETF (green) is performing worse.

Why?

Because currency fluctuations have had a positive effect since mid-2014.

From mid-2014 to the end of 2022, the euro lost around 30% in value. Therefore, the ETF whose currency risk is not hedged (blue) performs better.

You ask yourself why you need an ETF that hedges the currency risk.

Because fluctuations in the currency market can also have a negative impact. Sideways markets tend to return at least to the middle. The EUR/USD exchange rate is currently in the lower third. Therefore, as the weakness in the euro is likely to recede over the next few years and decades, the two curves will converge again.

What does this mean?

If you have a currency-hedged ETF, you prevent currency risk from having a negative impact on your investment: the unhedged ETF (blue) will underperform the currency-hedged ETF (green) when the US dollar weakens.

Should this scenario materialize, it will be to the detriment of investors in non-currency-hedged assets (stocks or ETFs) for decades to come.

Therefore, I strongly recommend that investors in the euro area invest in a currency-hedged ETF over the next few years.

This is a key detail in choosing the right ETF.

Investment products in your home currency (Euro)

Of course, you can also invest in investment products in your home currency. These are shares of European companies or ETFs on European indices.

I'm not a fan of European stocks, but there are some that do very well by international comparison.

Diversification

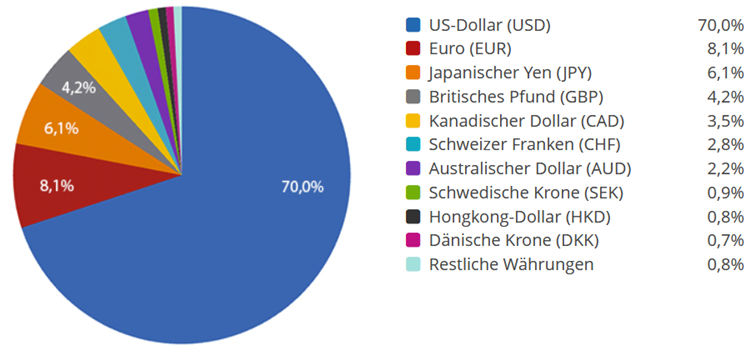

Diversify: Choose investment products in different currencies. This reduces currency risk, but does not avoid it. Be aware that the MSCI World is constantly changing its breakdown. So your investment there is even subject to a changing currency risk. Currently (09/2022) the proportion of US stocks is 70%.

Savings plan for the next 20 years

If you invest with a savings plan for the next 20 years, the currency risk is negligible.

The idea behind this is that the sideways market in the euro/US dollar will persist for the next 20 years and the risk is therefore only temporary. In addition, with a savings plan you get an average exchange rate, since your payments are spread over many years.

One-time investment for the next 20 years

Currently in January 2023, the euro is close to the lows of 2001. If the sideways market remains intact, investors in the euro area who invest in US stocks or ETFs without currency hedging have a significant currency risk.

If the exchange rate bounces back from 1.0 to 1.40, that's a currency risk of about 28% of lost profits.

You can counteract this by choosing a currency-hedged ETF.

However, if you want to invest in US stocks, things get a little more complicated and you could hedge your risk with so-called financial derivatives, options or futures.

Active trend following strategy with currency hedged ETF

My strategy is to only be invested in intact trend phases. The inloopo stock market indicator shows me the right timing for this.

So, I hold 100% cash in major market corrections like 2022 or the Corona Crash in 2020. I reinvest my money fully when the uptrend starts again.

In order to correctly implement the signals, it is important to invest in a currency-hedged ETF. I don't want to deal with currency risk because I know it can be to my disadvantage as well.

Summary

You now know what the currency risk is when investing with ETFs and how you can avoid them.

If you invest in currencies other than your own, check your investment period and whether you're making a one-off payment or investing with a savings plan.

Use my inloopo stock market indicator for your investment in a currency-hedged ETF.

PS: You can use the knowledge about currency risk for yourself, as it can also have a positive impact on your performance.