JustETF wants to make ETFs more accessible for beginners and take away fear.

The author says it like this:

"Over the past 50 years, you would have always had a positive return on an investment in the MSCI World Index if you had been invested for at least 14 years."

I don't know if I would be more fearless now.

14 years is a long time.

I wonder how an ETF beginner survives when they’ve been struggling for their money for over a decade while the stock markets crash before their eyes. After many nervous breakdowns and anxiety attacks, their investment is +- zero after 14 years.

Even an investment professional has a hard time mentally enduring that.

I'm sure there will be times again when the global stock indices go down for several years and new all-time highs are not regained for a long time.

Then you wait several years to return to the level of your deposit.

Is there another way?

And.

Do you want to know how to do it?

Please read on!

Facts at a glance

ETFs means Exchange Traded Funds.

ETFs can be bought and sold on the stock exchange at any time.

ETFs usually track the performance of a specific index.

ETFs are transparent: Individual companies and their weighting can be viewed at any time.

ETFs can have stocks, bonds, commodities or real estate in their portfolio.

#01 Acquire knowledge

Here we go.

ETFs simply explained.

An ETF is like a stall at a tourist market in Thailand, selling everything from incense sticks to rugs. You leave the stand with a full backpack and the carpet for the hallway of your Berlin apartment under your arm.

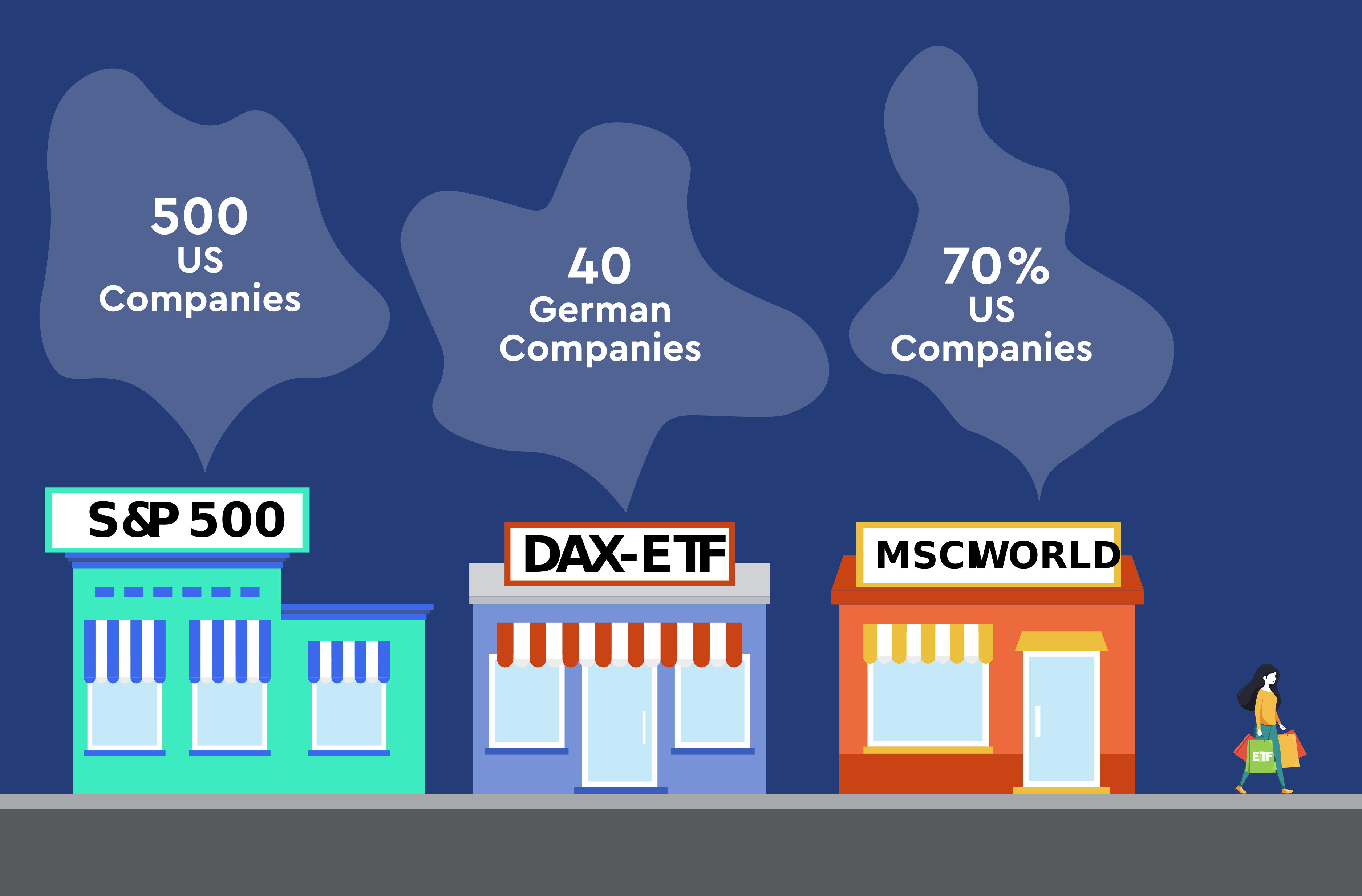

Now the arc to ETFs. There are various ETF booths with many different companies stacked on the shelves. In the DAX-ETF shop there are the 40 largest German companies. If you go shopping in the MSCI World store and you get shares in over 1,600 companies from 23 countries.

For example, you can spread your investment across the 40 largest German companies with a single DAX ETF. In addition to stocks, you can also invest in many other countries or specific asset classes or sectors with ETFs.

ETFs offer you the opportunity to invest in many companies at the same time with the purchase of a single ETF.

More ETF knowledge for beginners:

Technical Term | Description |

|---|---|

Stock Exchange | Digital marketplace where you can buy and sell financial products. |

Index | An index tracks the performance of a specific market. It represents a group of companies (e.g. the largest companies in a country). The German share index (DAX), for example, contains the 40 largest companies in Germany. |

Shares | Stocks are financial products that represent shares in a company. When you buy a share, you own part of the company. |

Stock Index | A stock index represents the stock market of a specific country or sector. |

Index ETF | Index ETFs are funds that replicate a specific index as precisely and automatically as possible. |

Financial Product | Financial products are products traded on the stock exchange. Important financial product types are ETFs, stocks, bonds, certificates, warrants, and funds. Each type has numerous characteristics and differ in risk profile. |

Yield / Performance | The return or performance is the percentage gain on your investment, usually within a year. The percentage indicates the profit in relation to the invested capital. |

Currency Hedged | With a currency-hedged ETF, the exchange rate fluctuations of, for example, the euro/US dollar are hedged (technical term: hedged). This is particularly important if you invest in financial products from the USA. |

Total Expense Ratio | The annual costs of investment funds are given in the Total Expense Ratio (short: TER). |

Tracking Error | Tracking error describes the performance deviation of the ETF to the index shown. |

Diversification | Diversification means spreading your money and thus spreading possible risks. |

Dividend | The dividend is a share in the profits of a company. It is paid to shareholders in the form of a distribution. |

Fund | A fund pools the money of many investors in one portfolio. Usually the money is actively invested by a human or a computer according to a certain strategy. The money is mainly invested in several companies, countries, or markets, which is intended to reduce the risk. |

Fund Manager | Fund managers work for funds and investment companies. They take care of the selection and trading of financial products. However, actively managed funds incur additional fees. ETFs have very low fees because they are computer controlled. |

#02 Know the downsides

ETFs are inexpensive and can be traded at any time. They make it easier to diversify an investment. There is a wide choice.

Great!

It's easy to overlook the downsides. Because the devil is in the ETF details that are listed in the fact sheet.

Some banks have over 2,000 different ETFs to choose from. This wide range is excellent, but it leaves you with the challenge of finding the best ETF for your money with the fewest downsides.

Here are the 4 main cons you should know about:

Dependence on the index:

In most cases, the ETF tracks an index and therefore has the same performance, unless you buy a US dollar-denominated index ETF without currency hedging. Then your investment is subject to an additional currency risk.Insolvency of the ETF provider:

You entrust your money to an ETF provider, so be careful how they invest your money. You can see this in the replication method. Choose physical replication here to eliminate the risk of bankruptcy.Inertia:

With an ETF, you invest your money passively. There is no one to protect your money from a stock market crash unless you do it yourself.No excess returns:

An ETF can only achieve the same performance as the index. A better performance is not possible.

#03 Choose an investment strategy

Research your ETF strategy and choose one that suits you!

Here are three strategies that work:

Can you mentally survive the next multi-year stock market crash without having to end your ETF savings plan in an emotional reaction at the bottom?

If your answer is "Yes!", then Buy and Hold fits as a one-time investment or even better as a monthly savings plan.Would you like to take care of your money a little more actively and not be invested in every stock market crash, for example?

If so, then an active ETF strategy with a signal service will do.You want someone to actively take care of your money and protect your capital from the next big stock market crash?

If so, then take a look at my eToro account with the inloopo stock market indicator.

#04 Open a deposit account

If you want to invest in stocks and ETFs over the long term, look for low fees for your ETF savings plan or the investments you use to implement your ETF strategy. The following online brokers in particular can be considered for people living in Germany:

JustTrade*

No order costs for wikifolios, therefore preferred for replicating the managed account. Very versatile product range, including cryptocurrencies and very low order feesScalable.Capital*

More than 2,000 ETFs can also be traded free of charge as a savings plan.Trade Republic:

Well known to many young investors due to the intuitive smartphone app and the low order costs.Flatex:

An old hand among online brokers and very diverse in terms of product range and order types.And many more…

For active investors and traders there are even more versatile and cheaper international brokers.

#05 Choose the right ETF

ETFs are like birds in the sky. There are many opinions about which ETF is the right one. As you browse the ETF rummage table for the most suitable one, pay special attention to the details in the fact sheet (see next 7 points).

You're wondering what I would recommend to you?

Make it easy on yourself and take a currency-hedged and physically tracking ETF on the S&P 500 Index. It is liquid and offers sufficient diversification of your money.

For example, the ETF "iShares S&P 500 EUR Hedged UCITS ETF (Acc)" with the ISIN: IE00B3ZW0K18 / WKN A1C5E9.

Not convinced?

No problem.

Pay particular attention to these details when choosing an ETF:

5.1 Market (Index) Select

First, think about which market you want to invest in. The best way to do this is to look at a comparative chart of performance over the past 20 years or more.

Indices compared to the inloopo S&P 500 strategy

In this comparison chart you can see the performance of the most well-known indices: DAX, MSCI World, MSCI Emerging Markets, S&P 500, Dow Jones Industrial Average and the NASDAQ.

When choosing the right ETF, the following 2 points are important to me but are considered opponents:

Diversification | ↔ | Product Overview |

|---|---|---|

All business sectors should be represented | ↔ | Countries, currencies, number of companies |

If you take a closer look at these two points when choosing an ETF, the NASDAQ falls away because it only contains companies from the technology and communications sector in the USA. There is not enough diversification.

Investing in the MSCI World is also out of the question for me, as this index contains over 1,600 companies from 23 countries. Which is too confusing for me in terms of currencies and number of companies.

The DAX Index and the MSCI Emerging Markets both show no good performance in the last 10 years and are therefore also excluded.

That leaves the Dow Jones Industrial Average with 30 US companies and the S&P 500 with the 500 largest US companies.

On the basis of solid diversification and a simple structure, S&P 500 Index is the only option for me as a basis for my investments.

5.2 Managed ETF volume should be greater than 500 million

Pay attention to the ETF size. The money under management should be greater than 500 million. This way you avoid investing in exotic ETFs with less liquidity. You also make sure that the ETF has existed for a few years.

5.3 Index type: select Total Return Index (Performance Index) --> Never: price index!

Pay attention to the index type when making your selection. Be sure to choose the Total Return Index or Performance Index. You also benefit from company dividends.

5.4 Replication method: choose physical --> never: synthetic!

Choose full physical replication or optimized sampling. The ETF provider invests your money in shares of the index and you have no counterparty risk. The disadvantages of the higher total expense ratio are almost non-existent today due to the further development of computer models.

5.5 Tracking Difference and Total Expense Ratio (TER): 0.05% to 0.25% pa

Look for a low total expense ratio (TER). This should be less than 0.25% per year. If you want to dig even deeper, compare the charts of your favorite ETFs over the last 3-5 years and look at the tracking error.

5.6 Distribution: Accumulating (Reinvesting) vs. Distributing

When choosing, it is mostly a question of tax and your investment objective. If you want to invest for the long term or don't care about the withholding tax on distributions, choose an accumulating ETF. This means that the company's dividends are reinvested directly in the ETF without a distribution to you. If you would like a distribution to your account, you can of course also choose a distributing ETF.

5.7 Currency Risk: Currency Hedged vs. Currency Unhedged

As a last, albeit underestimated point, you should think about whether you want to invest in a currency-hedged ETF or not. Be aware that most ETFs contain a larger proportion of shares in other currencies and your investment is therefore subject to currency fluctuations.

There are now also cheap currency-hedged ETFs and you no longer have to worry about exchange rate fluctuations.

You can find all these details on the JustETF website or on other ETF comparison sites.

Found an ETF?

Excellent! Then start investing with a strategy.

#06 Choose the right timing

You ask yourself: When is the right time to buy an ETF?

This is a very important question, because you can significantly increase your returns in the long term.

I have answered this question in detail in my separate blog article and present you with a suitable solution for every time horizon.

When is the best time?

When is the best day of the week?

When is the best month?

When is the best time in general?

#07 Execute your strategy

Get started and implement what you have learned. If you are still unsure, invest a small amount. Keep researching until you're as safe as driving a car. There is a lot to learn and you can always change your mind because you keep your money under your control.

Here are my step-by-step instructions with ETF recommendation:

Open broker account:

JustTrade* or Scalable Capital*Investment strategy:

➤ Buy and hold as a savings plan. Be aware that your account may not make a new all-time high for several years.

➤ ETF strategy with inloopo signal service (approx. 2 transactions per year)

➤ eToro for passive investors with crash protectionETF selection:

iShares S&P 500 EUR Hedged UCITS ETF (Acc)

ISIN: IE00B3ZW0K18 / WKN A1C5E9.Persevere and benefit from the compound interest effect for many years 😊

Conclusion: Why do you need a strategy?

Like a good friend an investment strategy protects you from making wrong emotional decisions.

Be aware that there will be some stock market crashes over the next 30 years. With a buy and hold strategy, it can take years for your account to reach new highs again.

My goal with the inloopo ETF strategy is to reduce the risk of your investment and at the same time achieve better long-term performance than the S&P 500 index.

If that's too much trouble for you, take a look at my eToro Account.